India's banking sector is a vital pillar of the country's economy, acting as a bridge between capital surplus and capital deficit areas. It has evolved significantly over the past few decades, embracing technology, expanding financial inclusion, and fostering economic growth. The sector comprises public sector banks (PSBs), private sector banks, regional rural banks (RRBs), cooperative banks, and foreign banks.

As of 2025, India's banking landscape is one of the most robust in the emerging market economies, supported by strong regulatory oversight from the Reserve Bank of India (RBI) and an expanding customer base driven by digital banking and fintech growth.

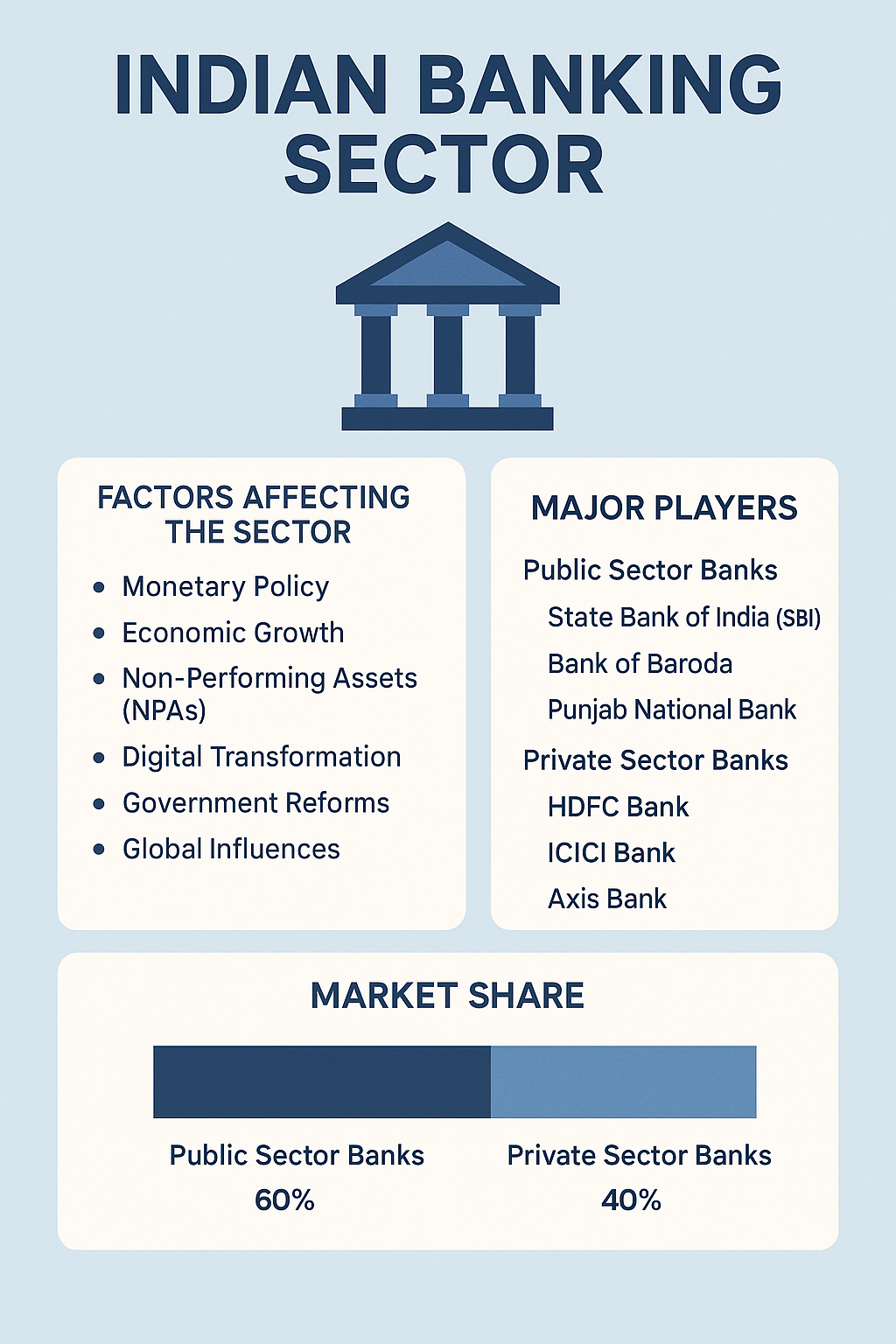

RBI’s interest rate decisions (repo rate, CRR, etc.) influence lending and deposit rates.

Banking sector performance is closely tied to GDP growth, consumption, and industrial activity.

High NPAs, especially among public sector banks, impact profitability and lending capacity.

Fintech integration, UPI, and mobile banking are reshaping customer behavior and bank operations.

Recapitalization plans, mergers of public banks, and schemes like Jan Dhan Yojana have transformed the sector.

Foreign capital flow, oil prices, and geopolitical tensions can affect the sector’s stability.

Programs like PMJDY and the expansion of digital banking have increased rural access to formal banking.

India's banking sector continues to be a dynamic landscape of competition, reform, and growth. With public banks providing scale and reach, and private banks leading in innovation and efficiency, the future of Indian banking lies in collaboration, digital transformation, and inclusive finance.

| Bank Name | Type | Market Share (%) |

|---|---|---|

| State Bank of India (SBI) | Public | 23% |

| HDFC Bank | Private | 10% |

| ICICI Bank | Private | 8% |

| Bank of Baroda | Public | 6% |

| Axis Bank | Private | 5.5% |

| Category | Market Share (by Assets) |

|---|---|

| Public Sector Banks | 60% |

| Private Sector Banks | 36% |

| Foreign Banks & Others | 4% |

Note: While PSBs lead in total market share due to legacy presence and government backing, private sector banks dominate in profitability, innovation, customer service, and digital adoption.